All Categories

Featured

Think About Making use of the cent formula: penny stands for Financial debt, Earnings, Mortgage, and Education and learning. Overall your financial debts, mortgage, and college expenditures, plus your wage for the variety of years your family members requires defense (e.g., until the kids are out of the house), and that's your coverage requirement. Some economic specialists compute the amount you require making use of the Human Life Value viewpoint, which is your life time earnings potential what you're earning now, and what you expect to make in the future.

One method to do that is to seek business with solid Monetary toughness ratings. level death benefit term life insurance. 8A company that underwrites its own plans: Some companies can offer policies from another insurer, and this can add an additional layer if you intend to transform your policy or later on when your family requires a payout

Term Life Insurance Expires

Some companies use this on a year-to-year basis and while you can anticipate your rates to increase significantly, it might deserve it for your survivors. Another method to contrast insurer is by looking at on-line customer evaluations. While these aren't most likely to inform you a lot concerning a firm's financial stability, it can inform you how simple they are to work with, and whether cases servicing is an issue.

When you're more youthful, term life insurance can be a basic way to secure your liked ones. As life adjustments your economic priorities can as well, so you might desire to have entire life insurance coverage for its life time coverage and additional benefits that you can utilize while you're living.

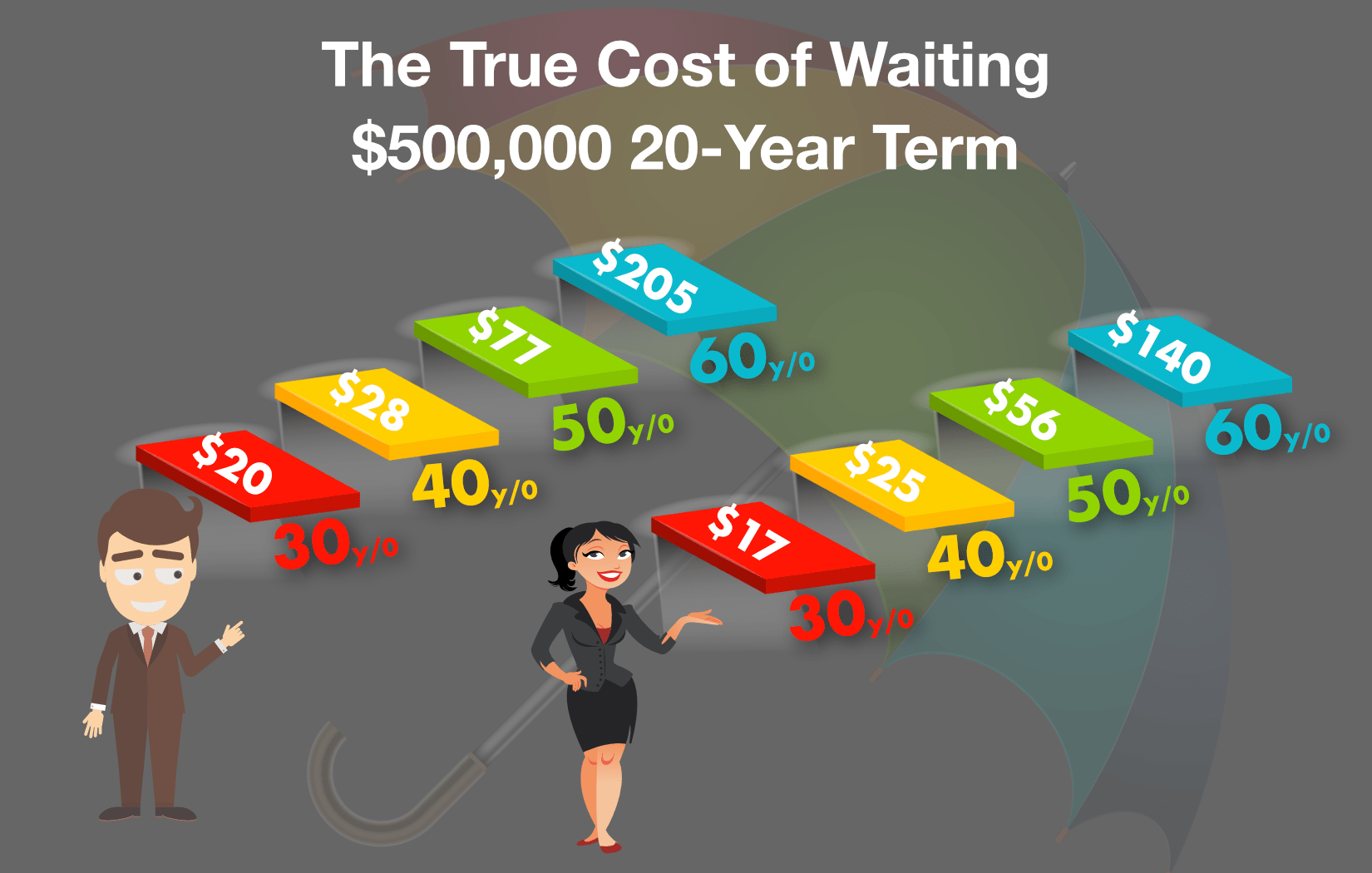

Authorization is assured no matter of your wellness. The costs will not boost as soon as they're set, but they will go up with age, so it's a good idea to lock them in early. Figure out more about how a term conversion works.

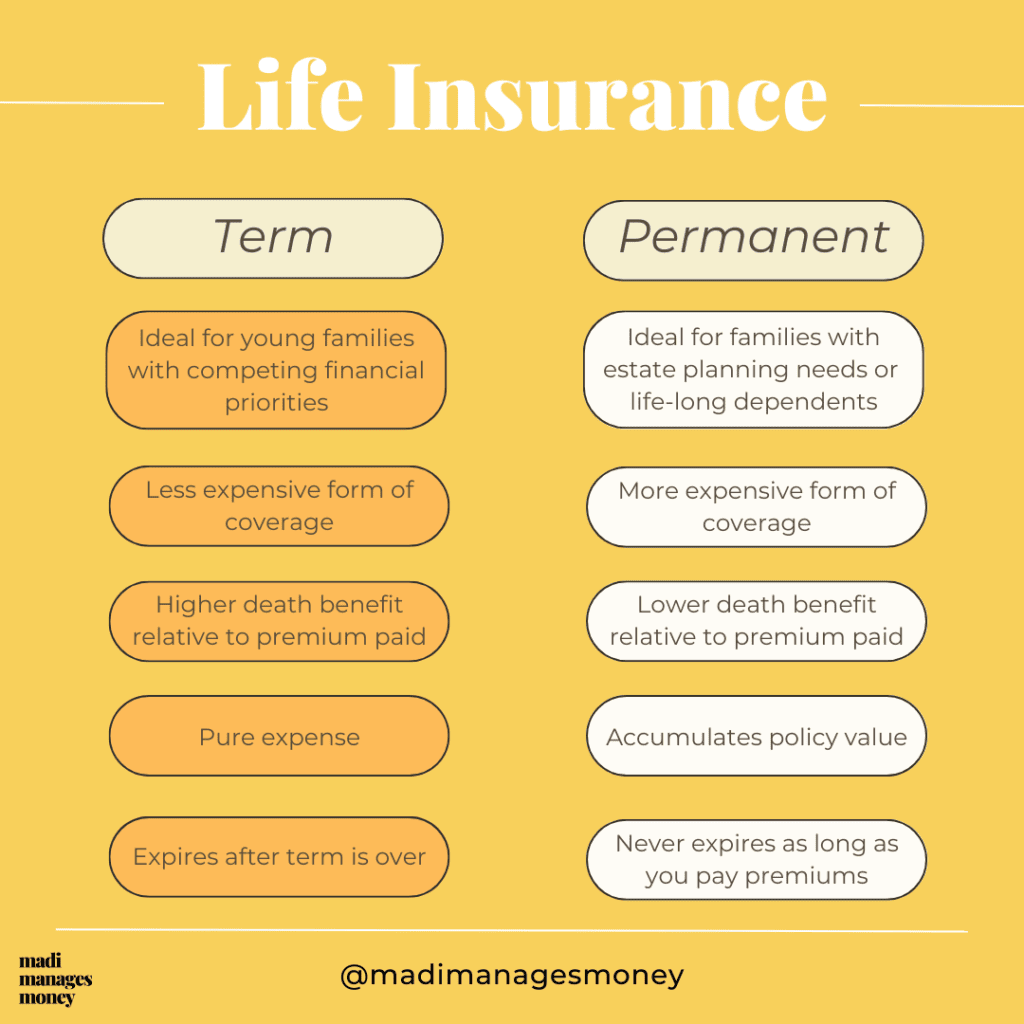

1Term life insurance supplies momentary defense for a vital duration of time and is typically cheaper than irreversible life insurance. decreasing term life insurance definition. 2Term conversion guidelines and constraints, such as timing, might use; as an example, there might be a ten-year conversion opportunity for some products and a five-year conversion benefit for others

3Rider Insured's Paid-Up Insurance policy Acquisition Option in New York. There is a cost to exercise this motorcyclist. Not all taking part policy proprietors are eligible for returns.

Latest Posts

The Term Illustration In A Life Insurance Policy

15 Year Term Life Insurance Policy

Simplified Term Life Insurance